ACCT6005 Assignment 2

Lilly Ltd is a public reporting entity and is required to prepare consolidated financial statements for the group. The company accountant has made the following adjusting entries in the worksheet for the year ended 30 June 2021 and each entry is independent. Corporate tax rate is 30%.

Required:

Discuss the purpose of each entry and the reason why each account has been increased or decreased.

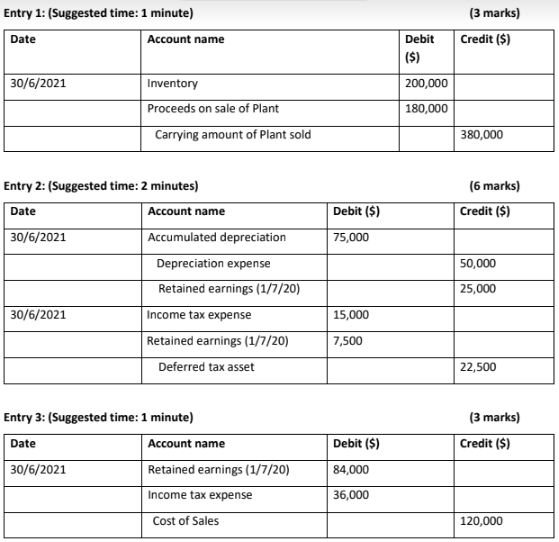

$200000 is the recorded amount of inventory in the company's accounts that is subsidiary rather than the parent company. As per the Australian Accounting Standard Board 10, the parent firm must prepare the financial statement to consider the transactions that occur in both the parent and the subsidiary firms. As per the MBA Assignment Expert, $380000 has been credited for the carrying amount of the plant sold. Therefore, the value of the plant in the company's balance sheet will reduce. On the other hand, the inventory account has been debited with $200000. Therefore, the inventory value in the current account section of the balance sheet will increase. The sale of a plant that amounts to $180000 decreases the income has been adjusted in the parent firm's financial statement.

The parent company must adjust the impact of depreciation before the firm's financial statements have been prepared. As a result, $50000 has been credited as the part of depreciation expense. However, the accumulated amortisation of the company is $75000. Therefore, the decline in the provision of accumulated depreciation is being credited at $25000 as retained earnings. Thus, the profit of the company will increase. As per the Australian Accounting Standard Board 10, the company must change the income from the gain that the firm has made while the firm has been preparing the financial statements (Aasb.gov.au, 2022). As a result, the depreciation expense has declined because the entries have been adjusted in the parent firm.

Since the company has incurred some depreciation expenses, the tax expense has also been affected. In the case of the given situation, $15000 has been debited as the income tax expense. $22500 is the amount that has been credited as a deferred tax asset. As a result, $7500 has been debited from the company's retained earnings. The deferred tax asset will assist the firm to reduce its taxable income in the future. The addition of retained earnings amounting to $7500 allows the firm to increase the benefit that the company might receive from the increase in deferred tax assets. Such kind of a transaction that subdues the depreciation might not be passed as an entry that is very distinct from the perspective of accounting standards.

In the given case, $120000 has been credited to the cost of the sales account of the parent company. This is because of the elimination of the sales by the intragroup for the income that is being generated from the sales has been adjusted with $84000 being debited from the retained earnings account. On the same occasion, $36000 is being debited to the income tax expense account as well in order to keep the sanctity of the adjustment. As per the Australian Accounting Standard Board 3, the retained earnings of the firm must be recognized while the financial statements of the firm are being prepared by the parent firm (Aasb.gov.au, 2022). As a result of such standards, $84000 and $36000 has been debited from the retained earnings and income tax expenditure account, respectively.

Aasb.gov.au. (2022). Retrieved 23 March 2022, from https://www.aasb.gov.au/admin/file/content105/c9/AASB10_08-11.pdf.

Aasb.gov.au. (2022). Retrieved 23 March 2022, from https://www.aasb.gov.au/admin/file/content105/c9/AASB3_08-15.pdf.

Essay: 10 Pages, Deadline: 2 days

They delivered my assignment early. They also respond promptly. This is excellent. Tutors answer my questions professionally and courteously. Good job. Thanks!

![]() User ID: 9***95 United

States

User ID: 9***95 United

States

Report: 10 Pages, Deadline: 4 days

After sleeping for only a few hours a day for the entire week, I was very weary and lacked the motivation to write anything or think about any suggestions for the writer to include in the paper. I am glad I chose your service and was pleasantly pleased by the quality. The paper is complete and ready for submission to the professor. Thanks!

![]() User ID: 9***85 United

States

User ID: 9***85 United

States

Assignment: 8 Pages, Deadline: 3 days

I resorted to the MBA assignment Expert in the hopes that they would provide different outcomes after receiving unsatisfactory results from other assignment writing organizations, and they genuinely are fantastic! I received exactly what I was looking for from this writing service. I'm grateful.

![]() User ID: 9***55

User ID: 9***55

Assignment: 13 Pages, Deadline: 3 days

Incredible response! I could not believe I had received the completed assignment so far ahead of the deadline. Their expert team of writers effortlessly provided me with high-quality content. I only received an A because of their assistance. Thank you very much!

![]() User ID: 6***15 United

States

User ID: 6***15 United

States

Essay: 8 Pages, Deadline: 3 days

This expert work was very nice and clean.expert did the included more words which was very kind of them.Thank you for the service.

![]() User

ID: 9***95 United

States

User

ID: 9***95 United

States

Report: 15 Pages, Deadline: 5 days

Cheers on the excellent work, which involved asking questions to clarify anything they were unclear about and ensuring that any necessary adjustments were made promptly.

![]() User ID: 9***95 United

States

User ID: 9***95 United

States

Essay: 9 Pages, Deadline: 5 days

To be really honest, I can't bear writing essays or coursework. I'm fortunate to work with a writer who has always produced flawless work. What a wonderful and accessible service. Satisfied!

![]() User ID: 9***95

User ID: 9***95

Essay: 12 Pages, Deadline: 4 days

My essay submission to the university has never been so simple. As soon as I discovered this assignment helpline, however, everything improved. They offer assistance with all forms of academic assignments. The finest aspect is that there is also an option for escalation. We will get a solution on time.

![]() User ID: 9***95 United

States

User ID: 9***95 United

States

Essay: 15 Pages, Deadline: 3 days

This is my first experience with expert MBA assignment expert. They provide me with excellent service and complete my project within 48 hours before the deadline; I will attempt them again in the future.

![]() User ID: 9***95 United

States

User ID: 9***95 United

States